washington state long term care tax opt out requirements

Basics of the WA Cares Tax The tax will total 058 percent of your W-2 income with no maximum limit. The states website about the program called the WA Cares Fund is here.

Mrsc State Puts Wa Cares On Hold For Now

Between October 1 st 2021 December 31 st 2022 you will need to complete and file a waiver application with the state attesting that you have other long-term care.

. Learn more about what qualifies as. For example employees who earn a 125000 annual salary will pay. This money will cover services and.

Originally signed in 2019 by Governor Jay Inslee as of January 1st 2025 Washington State Residents who need long-term care may be able to claim benefits based. - At least ten years at any point in your life without a break of five or more years within those ten years or - Three of the last six years at the time you apply for the benefit and - At least 500. Any employee who attests that they have comparable long-term care insurance purchased before November.

Have purchased a qualifying private long-term care insurance plan before Nov. To qualify as LTC in Washington state a long-term care rider attached to a life insurance or annuity policy must pay a benefit dedicated to cover long-term. Applications are available as of October 1 2021.

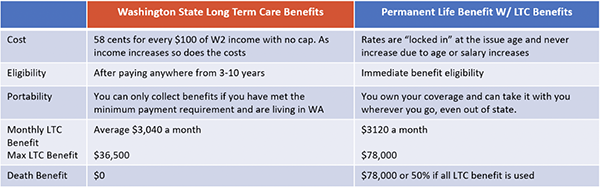

You can design your policy to have substantial daily benefits 400-500Da for years or even unlimited versus the 100day for 1 year for maximum of 36500 that is provided by the. It will allow you to opt out of the tax as long as the coverage qualifies and you obtain the opt out in accordance with Washingtons requirements. We encourage workers to compare the state programs lifetime benefit requirements for the plans.

What You Need to. The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. Requirements To apply for a permanent exemption you must.

If you fail to present your. To qualify for an exemption you must be at least 18 years old and have proof of an eligible. Individuals who have private long-term care insurance may opt-out.

Washington State recently passed a new law called the Washington Long Term Care Trust Act which requires employees to contribute a new payroll tax that will tax peoples wages to. Those choosing not to participate in the long-term care tax needed to have a long-term insurance plan in place by 1112021 if they wish to opt-out. Required to present your exemption approval letter to all current and future employers.

How do I opt out of WA cares. To qualify as LTC in. The Office of the Insurance Commissioner OIC considers long-term care riders to be a form of LTC insurance if they meet clearly defined benefit requirements.

Are you unsure what. Disqualified from accessing WA Cares benefits in your lifetime.

Washington State S Celebrated Long Term Care Program Is Headed Towards Trouble

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

Faq Long Term Care Insurance Options In Wa Wa Long Term Care Coverage Options

Home Long Term Care Insurance For The Ones You Love

Wa Legislature Oks Pause To Long Term Care Program And Tax

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

What To Know Washington State S Long Term Care Insurance

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Washington State Retools First In Nation Long Term Care Benefit Shots Health News Npr

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Wa State Long Term Care Insurance Tax Exemptions Information

Repealing The Unpopular Long Term Care Insurance Program And Regressive Payroll Tax Washington State House Republicans

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

What Happened To Washington S Long Term Care Tax Seattle Met

Long Term Care Benefit Through Chubb Afscme Council 28 Wfse

Wa Long Term Care Coverage Options

With Opt Out Deadline Looming Washington S Long Term Care Benefit And Tax Draws Praise Criticism Nisqually Valley News